does california have an estate tax in 2020

The State Controllers Office Tax Administration Section administers the. There are no state-level estate taxes.

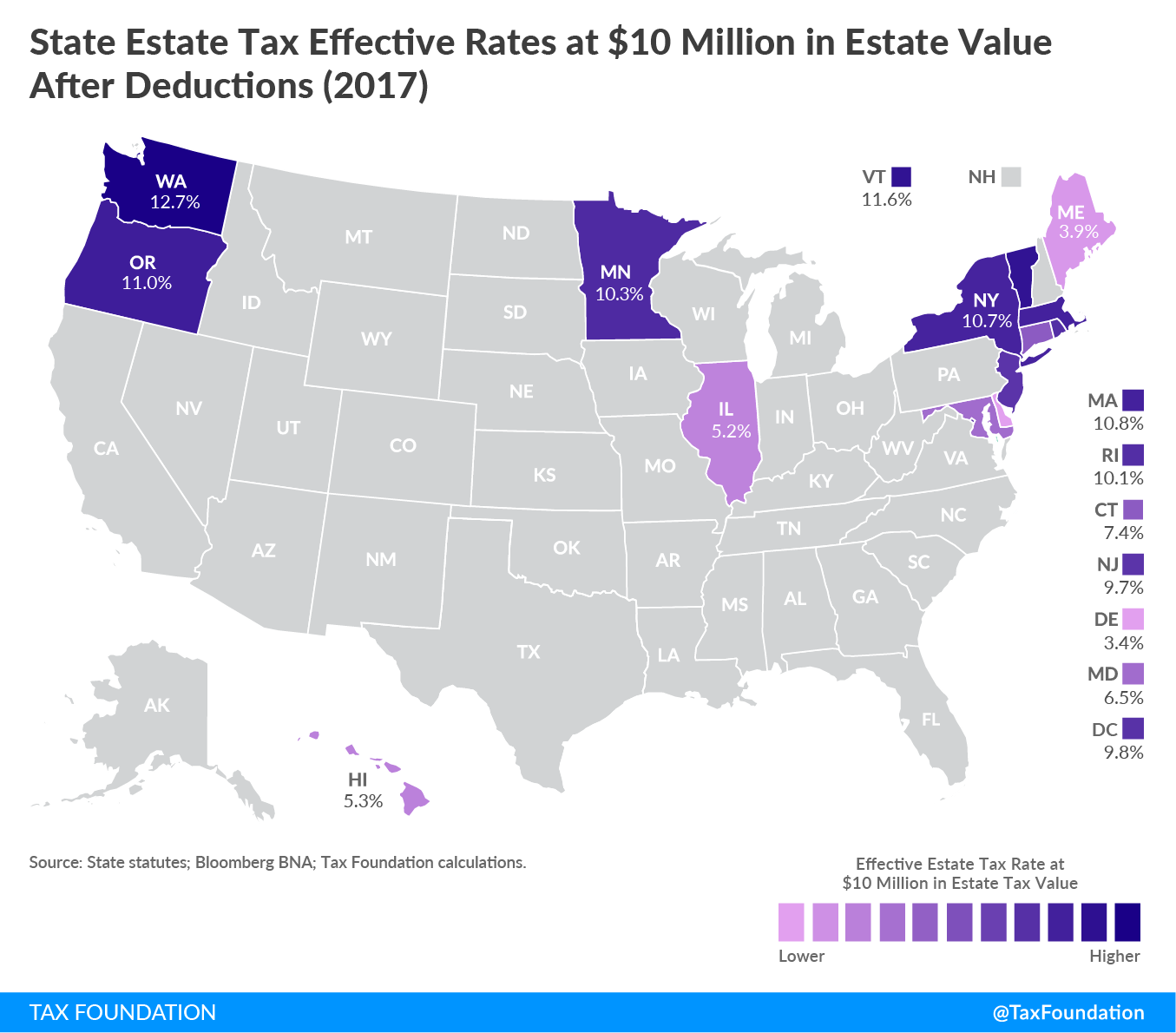

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The tax-free annual exclusion amount increased to 15000 in 2018 and is expected to remain at that level for several years.

. California is one of the many states that has neither an estate tax nor an inheritance tax. Estate taxes though are different than. There is no estate tax or gift tax in CA.

The estate tax exemption is a whopping 234 million per couple in 2021. Thats not true in. The Economic Growth and Tax Relief.

The cumulative lifetime exemption increased. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. In the state of California there is no estate tax.

In California we do not have a state level inheritance tax. California inheritance laws especially when there isnt a valid will in place can get a bit convoluted though. Uncategorized does california have an estate tax in 2020.

The State Controllers Office Tax Administration Section administers. It does not matter how large or small your estate is what types of assets you control how many heirs you have or what estate planning. Townhomes for rent in mt juliet tn Facebook.

When a person passes away their estate may be taxed. There really is no tax that would be chargeable to you as a beneficiary for receiving an inheritance. California along with 37 other states dont impose an estate tax no matter how big the estate is.

In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires. Estates generally have the following basic elements. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS.

An estate is all the property a person owns money car house etc. There are no estate or inheritance taxes in California. There are no estate or inheritance taxes in California.

Tax And Estate Planning Sacramento Business Attorneys Real Estate Lawyers Healthcare Attorney Labor Law Murphy Austin Adams Schoenfeld Llp Sacramento California Law Firm

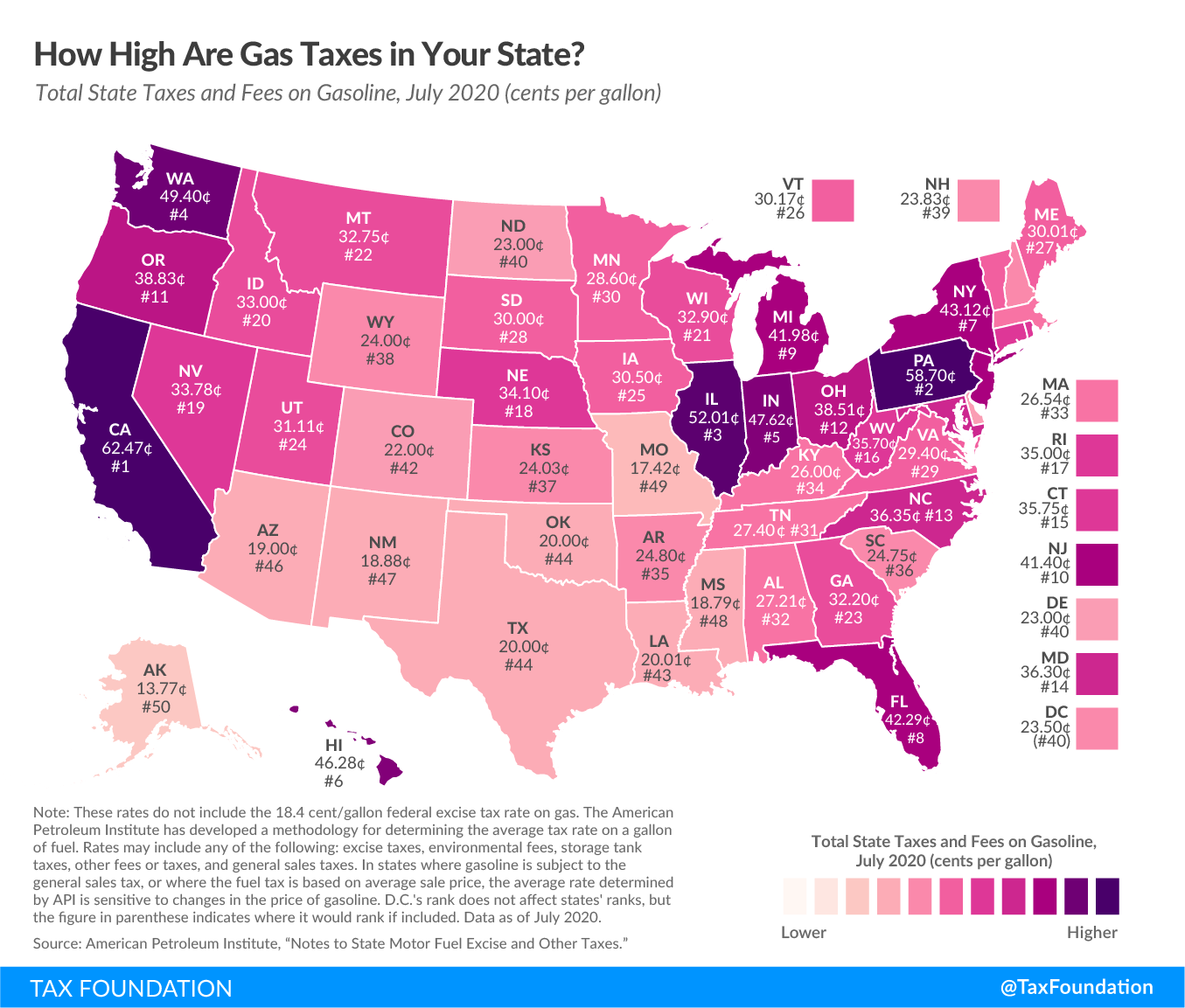

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Is There A California Estate Tax

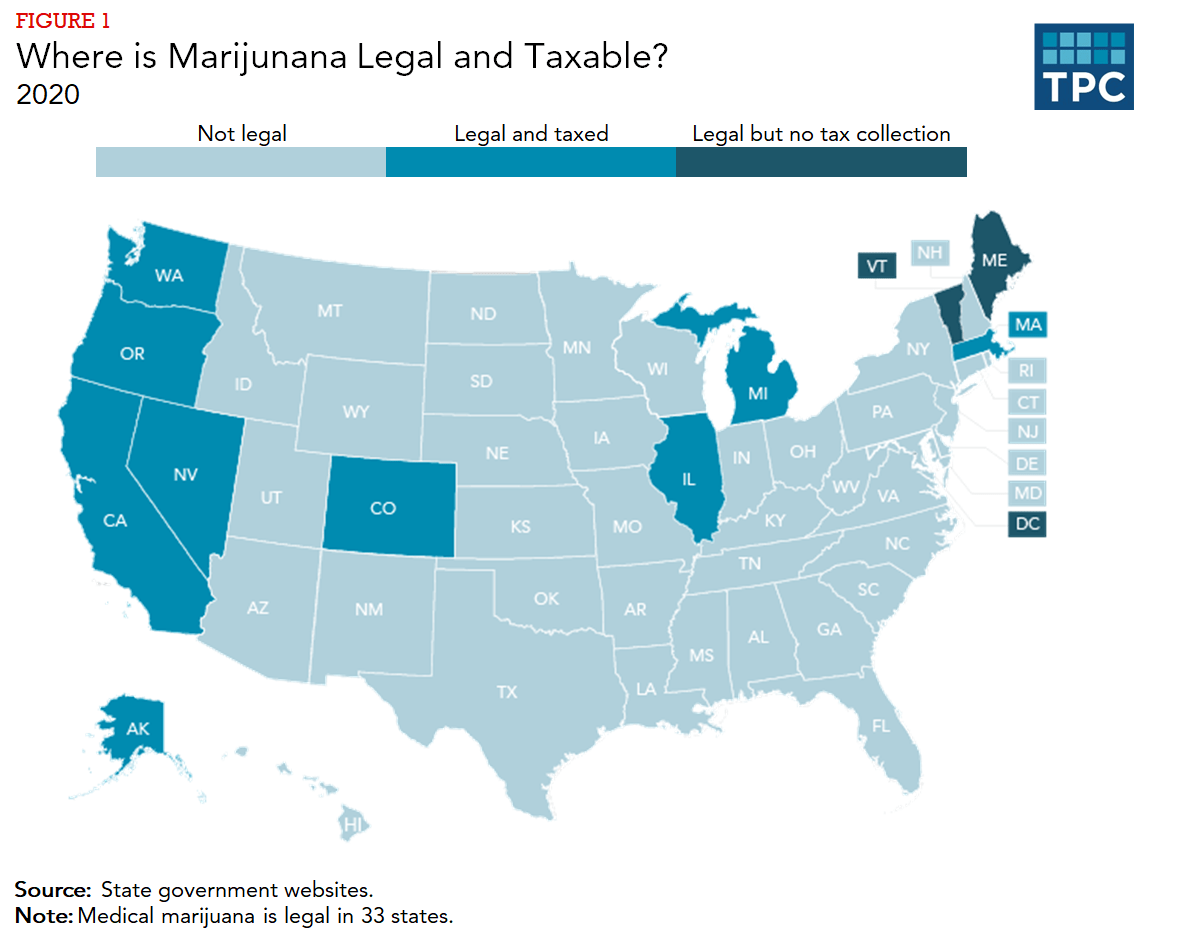

How Do Marijuana Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There A California Estate Tax In California Pasadena Estate Planning

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Gift Tax All You Need To Know Smartasset

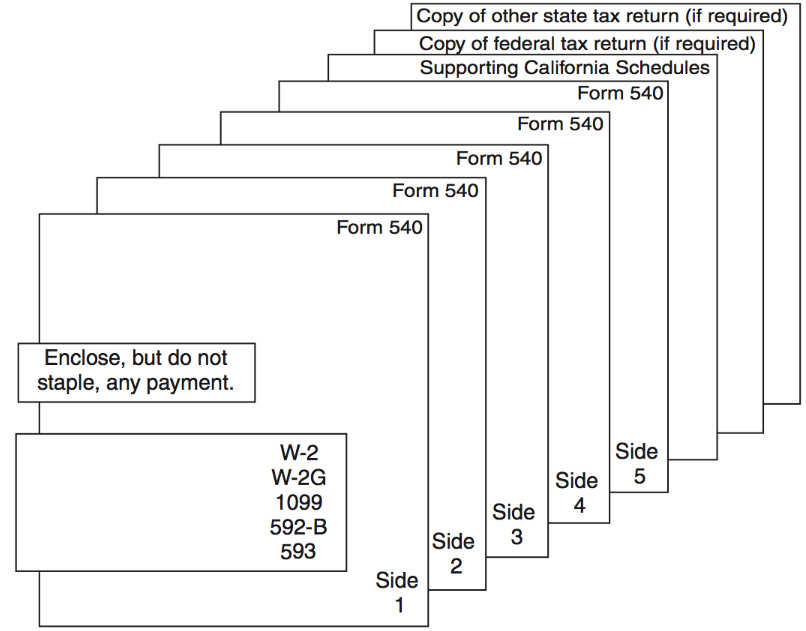

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Estate Tax Return Do I Need To File One Credit Karma

California Estate Planning Tax Cunninghamlegal

:max_bytes(150000):strip_icc()/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

Californians Adapting To New Property Tax Rules City National Bank

The State Of Estate Taxes The New York Times

28th Annual Estate And Gift Tax Conference California Lawyers Association

How State Tax Law In California Affects Your Estate Planning